Fundamentals of Nuclear Liability and Insurance

Key Points

In the United States, radiological risk from nuclear power plants is handled by a comprehensive liability, indemnification, and risk regime

The Price-Anderson Act is the main statute constituting this regime, derived from principles of protecting the public and promoting a commercial industry

To date, the overall regime has been effective at protecting the public and ensuring sufficient financial resources are available in case of a severe accident

With lower safety risks and less radioactive material inventories, future advanced reactors could require updates to Price-Anderson and the overall liability/insurance scheme

Comparably, other types of energy mega-liabilities and risks are under covered, meaning they are externalized and the public often suffers from private sector risk-taking

One of the defining characteristics of nuclear power is the very, very small chance of an accident with very large economic and safety consequences. In recognition of this and related issues, governments often develop distinct liability and insurance schemes for nuclear power to enable its use. In the United States, this framework is codified in the Price-Anderson Nuclear Industries Indemnity Act (named for its cosponsors in the 1957 amendments to the Atomic Energy Act of 1954). The Act is controversial, usually criticized by anti-nuclear advocates who label it a “subsidy” for nuclear energy or otherwise criticize it for not protecting the public.

In this post, I’ll provide an overview of commercial nuclear liability in the United States. Contrary to critiques, the liability and insurance scheme we have developed for nuclear energy is one of the most effective and comprehensive of any energy source. As we’ll see, other energy mega-disasters, like the BP Horizon Oil spill, PG&E wildfires in California, and climate change itself are not treated anywhere near as comprehensively as nuclear risk, leaving the public exposed. Note: Price-Anderson also deals with Department of Energy liability but that is beyond the scope of this post.

Liability and Nuclear Energy

To start, a simple question. What is liability?

Basically, you cannot hurt other people for free.

Liability is derived from common and statutory law, for both criminal and civil matters. It is a central part of human society – its principles are apparent in the Code of Ur-Nammu, the oldest known law code from more than 4,000 years ago.

Essentially, if party A damages party B then party A is responsible for those damages, usually in the form of monetary compensation. There are defenses against liability, such as the damages not being the fault of party A, because of an act of god or an act of war.

Car accidents are an everyday example. If you are involved in a car accident, you could be found to be financially liable for bodily injury to other people and property damage for other vehicles. If you are drunk driving, you are very likely to be found responsible. But if another person hit you at a stop sign then you are unlikely to be at fault. Thus, liability requires establishing a damage and a fault, although fault does not necessarily require intent.

Nuclear liability is not that different than other forms of liability. Yes, radiation can make establishing health damages somewhat challenging. But in many cases, the primary response to a severe nuclear accident is evacuation, avoiding questions over direct health impacts, whereas property damage is relatively straightforward to handle under general liability rules (i.e. loss of use, permanent loss).

However, nuclear liability is challenging because the complexity of a severe accident makes it very difficult to establish fault for a specific party. Conventional nuclear power plants are complex machines composed of millions of individual components and sub-systems, in turn manufactured and built by many sub-contractors.

If a major event happens, there are often multiple causes and establishing fault across the utility, designer, contractors, and even the regulator is not straightforward. This is especially true as the long lifetimes of nuclear power plants means that a specific company may no longer exist.

Nuclear Risk and Insurance

Crafting an insurance program requires more than just rules governing liability, it also requires understanding of risk.

When it comes to engineered systems and business risks, risk can be characterized by a relatively simple formula:

probability of something * consequences of it happening

Using actuarial tables and other data, insurance companies generally estimate both parameters, enabling them to price an insurance product to protect businesses or individuals. Most people are familiar with this – they have car insurance, homeowner’s insurance, or health insurance.

However, this basic formula is very difficult or impossible to apply to conventional nuclear energy to create an insurance product.

Why?

The probability of a severe accident seriously damaging a nuclear reactor and causing a release of radioactivity is remote. The probability of it being so bad that there are large economic losses or public safety threats is even more remote. Based on Three Mile Island (INES 5), Chernobyl (INES 7), and Fukushima (INES 7), an approximate rule of thumb is that there will be a severe accident about once in every ten thousand commercial operating years. Notably, 1-in-10,000 is also a safety benchmark used in some types of regulatory analysis.

The International Nuclear and Radiological Event Scale (INES). Source: NRC

However, there are three limitations in using this to create an insurance product.

First, industry and government wanted a liability program before any of these accidents happened, back in the 1950s. Risk numbers were not necessarily known when nuclear liability laws were first crafted.

Second, these specific incidents do not necessarily indicate the chance of a future reactor having an accident. Three Mile Island was relatively minor in terms of public exposure to radiation and led to an overhaul of U.S. safety regulation. Chernobyl was caused by a flawed reactor design and more reflected the decline of the Soviet Union and its closed society than nuclear risk. Fukushima was the result of one of the largest earthquakes in recorded history causing a 1-in-1,000+ year tsunami. Both earthquakes and tsunamis are considered “acts of god” by most insurance law and would normally not incur a liability or be covered by commercial insurance.

Third, even if we can estimate the risk of a severe accident, which is hard, it is exceedingly difficult to calculate how much it costs. It depends on many things, including the wind direction. In the worst-case scenario, accidents could cost tens of billions of dollars – this is much more than many insurance companies could cover.

Per this NRC example, worst case scenarios could cost billions but are ultra-rare. That’s a prototypical example of something hard to insure. Source: NRC

Collectively, these characteristics make it hard to create a fair insurance product that protects the public, industry, and insurance companies. So enters the Price-Anderson Act.

Motivation and Principles of the Price-Anderson Act

Following President Eisenhower’s “Atoms for Peace” speech in 1953, Congress passed the Atomic Energy Act of 1954, opening up nuclear energy for commercial applications for the first time. Initial efforts were spearheaded by the Atomic Energy Commission, the predecessor of the Department of Energy and Nuclear Regulatory Commission.

As the U.S. sought to promote commercial nuclear energy, it ran into a problem. Considering emerging concerns about rare but severe accidents, commercial companies were concerned about adopting nuclear energy as part of their overall business portfolio. Although supply chain companies such as Westinghouse saw a small market opportunity, a major accident could bankrupt the entire company. Further, it was not clear the insurance market could deliver any product to cover this risk, let alone an affordable product.

Accordingly, Congress recognized that a liability solution was needed to make nuclear power commercially viable.

As described by the Nuclear Regulatory Commission, the Act was intended to serve two primary purposes:

“1. Assure that adequate funds are available to the public to satisfy liability claims if a catastrophic nuclear accident were to occur.

2. Remove the deterrent to private sector participation in atomic energy presented by the threat of potentially enormous liability claims in the event of a catastrophic nuclear accident.”

Although commercial reasons were a primary catalyst of initial Congressional interest, it is critical to note that this scheme was also intended to strongly protect the public. Key principles of the overall scheme include:

Economic channeling of liability to the reactor operator

Establishing sufficient financial protection for the public

Limitations on liability in certain circumstances

Waiver of normal liability defenses like acts of god, acts of war, or acts of terrorism

Federal jurisdiction of nuclear liability, to assist in liability claims crossing state borders

Several of these are novel liability principles and are contributing factors to nuclear law being a unique area of law.

Timeline of Price-Anderson Act and key legislative changes Source

Of these provisions, economic channeling deserves some commentary. In effect, economic channeling means that all liability from an accident is the economic responsibility of the power plant operator. In effect this is strict liability, meaning that the operator is responsible for all damages, regardless of fault by specific individuals or companies.

There are two good reasons for this.

First, the reactor operator is the end-use operator of the systems-of-systems that is a nuclear reactor. They have the greatest ability to prevent an accident both through operational actions and through vendor selection. Considering the relative market capitalizations of supply chain companies, plant operators are also likely to remain solvent indefinitely and are in the best financial position to obtain insurance.

Second, by identifying one party responsible for all liability, the scheme guarantees the public is protected. In many types of legal malpractice, like medical or construction, even relatively small claims less than $1 million can lead to dozens of parties all suing each other. Such cases can take a decade or more to establish which entities are actually at fault, and that is usually only with one or a few primary plaintiffs.

In a severe accident with hundreds or thousands of members of the public potentially damaged, such a litigious outcome would mean many parties would suffer harm and not be made whole for years, if ever. Thus, channeling ensures that the public can get prompt and adequate financial compensation in the event of an accident.

Price-Anderson Insurance Requirements and Tiers

Beyond establishing the key principles above, Price-Anderson also creates a multi-tiered insurance scheme to handle radiological damages to the public from both small and large accidents.

The first tier as required by the Price-Anderson Act is primary insurance coverage. For each nuclear power plant (not reactor), plant operators are required to obtain $450 million in liability insurance from private providers to cover offsite liability from a nuclear accident. This is consider the “maximum” amount available from the private sector. Considering the low risk for most accidents, operators are able to obtain this insurance for about $1 million per reactor per year.

So far, this is just like (very expensive) car insurance, where you have a maximum amount of insurance available. The second tier is where things change.

In the event of an individual reactor accident exceeding the $450 million in primary coverage, all power plant licensees in the United States would pay an equal share of the excess liability cost, up to around $131 million per reactor. This is a shared liability pool.

Technically this is a public retroactive insurance premium. Whereas the first tier requires public insurance with an annual premium, this tier is only assessed in the event of a severe accident. There is an additional 5% surcharge for severe events.

Collectively, this insurance pool provides about $13 billion in coverage per reactor accident.

Source: Congressional Research Service (note non-PAA “tiers” excluded)

In the event that the public liability from an accident exceeds funds available from the first tier, second tier, and the surcharge, the additional costs are an open question. Under Price-Anderson, the nuclear industry’s liability for an incident is capped at that level (~$13.5 billion). For costs about that liability limit, the act creates special procedures that require Executive branch and Congressional intervention to determine ultimate payment sources.

Generally, it is assumed that costs in excess would be met by an emergency declaration and public funds, but that is not necessarily the case – it is possible that Congress could decide that the nuclear industry should bear the costs.

This is where the “Price-Anderson is a subsidy argument” comes in, as the potential use of public funds invokes the idea of a subsidy. The general idea is that the nuclear industry would not be able to exist without the public backing of any severe accident beyond the insurance tiers and thus that is a monetary value that is a subsidy.

In reality, Price-Anderson is a federally-designed private insurance scheme with an open question of whether an accident would ever require public funds. No industry is actually required to have insurance coverage for multi-billion dollar events. To the degree they have such risks they self-insure, meaning an effective maximum of their market cap. With today’s energy market rules, a company worried about liability for a large nuclear power plant could just structure it is a limited liability corporation, which would likely not have anywhere near $13.5 billion available to protect the public.

Beyond the three statutory tiers, there are two additional components of the American nuclear liability and insurance scheme.

First is a requirement for on-site liability insurance. After Three Mile Island, the Nuclear Regulatory Commission added a regulation that required power plant licensees to obtain insurance coverage for on-site damage to their power plant (as opposed to public damage covered by PAA). As of 2019, nuclear plant licensees are thus required to have at least $1.06 billion in coverage for damage to their private property.

Second is the international Convention on Supplementary Compensation (CSC), one of three international nuclear liability regimes. Under this treaty, the participants (11 countries as of 2021) are responsible for damages from a nuclear accident between about ~$400-550 million. Effectively, the CSC creates a supplementary tier to the Price-Anderson Act, covered by the U.S. government and other national governments, with the tier level occurring right around the Primary and Second insurance tiers.

How Effective is Price-Anderson?

To date, there has been one major nuclear accident in the United States that triggered the offsite liability provisions of Price-Anderson: the partial meltdown of Unit 2 at Three Mile Island.

Although estimates vary, somewhere between $71 and 151 million in liability damages were paid out by the plant operator/its insurer. These costs included immediate evacuation costs, lost wages, lost business profits, and health studies.

One estimate of the public liability costs of TMI. Source

This amount firmly fell into the first tier of Price-Anderson, requiring coverage by primary insurance, and so did not activate the shared liability pool. A number of smaller incidents at other reactors have led to small insurance payouts under the first tier.

To date, the second tier of shared retroactive premiums has not been used in the U.S.

An additional point of comparison are the meltdowns at Fukushima. Depending on how one accounts for the accident, there were either 3 or 4 reactors that suffered accidents at Fukushima that may have led to public offsite liability (probably 3). Estimating the total public liability of the accident is hard, but generally estimates range from the $50-150 billion range.

Had such an accident occurred in the United States, it would have triggered the $450 million site-level primary insurance, and likely three separate calls upon the secondary tier pool. This would have led to a total of about ~$40 billion available from the private sector to cover a Fukushima-scale accident in the U.S.

However, a few notes.

First, there are only three nuclear power plants with three reactors in the U.S. Most have two. Following Fukushima and subsequent actions by U.S. operators the risk of such an accident are even lower today. Its not clear that such a high-cost accident is possible in the U.S.

Second, the Fukushima accident was caused by one of the most powerful earthquakes in recorded history causing one of the most destructive tsunamis. Both of these are “acts of god,” and, but for an liability and insurance program like Price-Anderson, the nuclear industry would not normally be held liable for such an event.

Price-Anderson and Advanced Reactors

Like most of American nuclear energy governance, Price-Anderson was designed to primarily focus on large light-water reactors.

Looking forward, future nuclear reactors are likely to have very different risk profiles. Light-water small modular reactors and non-light water advanced reactors generally feature safety features that reduce both elements of the risk equation.

With inherent safety features that can automatically regulate fuel temperatures, the risk of an accident is reduced. With smaller capacities and sizes, the consequences if an accident occurs is also reduced. Current engineering estimates generally hold that advanced reactors are likely at least one order of magnitude safer and likely more.

Price-Anderson has special rules for advanced reactors. Many advanced reactors smaller than 100 megawatts would only be subject to the primary insurance tier and not the secondary tier. Microreactors may have minimal offsite liability requirements.

Examples of Price-Anderson requirements for advanced reactors. NEI

However, NRC regulations requiring on-site insurance as much as $1.06 billion do not change depending on the size of the reactor. This amount makes sense with a 1-gigawatt light water reactor, but not necessarily a 1-megawatt microreactor.

Price-Anderson is up for renewal in 2025, so Congress will have to examine the application of the liability and insurance scheme on next generation nuclear energy within several years. Critically, risk-informed liability laws can theoretically provide incentives for safety innovation, so getting any revisions right is important.

Liability for Other Energy Mega-disasters

Compared to nuclear liability and insurance, other energy sectors generally lack clear liability rules, have insufficient insurance requirements, and often leave public damages uncompensated.

In 2003, First Energy caused the largest blackout in North American history, taking out power to as many 50 million US and Canadian customers for up to 4 days. First Energy did not properly trim trees near its power lines and a subsequent operator alarm failed, leading to a cascade that caused the black out. Estimated economic costs ranged from $6-12 billion.

How much did First Energy pay? $0.

There is no clear framework for economic damages from blackouts, even in cases where a specific utility is at fault and acted negligently.

Today’s electric grid means that any large enough grid participant could be a primary factor causing a $1+ billion blackout. Given cybersecurity and other emerging issues, even a renewable facility can negligently cause billions in damages without clear liability.

Another (very tragic) example of energy-sector mega-disasters have been wildfires in California caused by power lines. Beginning in 2018, a confluence of climate change, poor woodland management, and negligence on the part of PG&E in terms of power line maintenance led to hundreds of wildfires, some of which have killed many people and destroyed entire towns.

The liabilities from these fires led to PG&E declaring bankruptcy in the face of tens of billions in potential claims. Since 2019, PG&E has paid more than $25 billion in damages and will invest more than $10 billion in line upgrades. Although some debt may be excused due to the bankruptcy, a particular quirk of California liability law is critical here: PG&E is subject to strict liability, meaning that negligence need not be proved. As we look elsewhere across the West, other states’ laws may not be as comprehensive and leave the public exposed to uncovered wildfire risk.

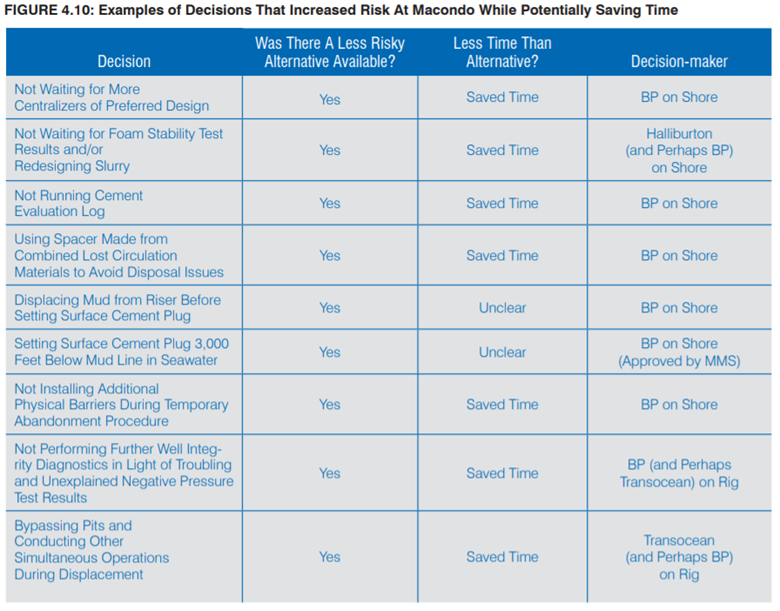

Even the PG&E wildfire damages were eclipsed by economic damages from the BP Horizon Oil spill. As a result of shoddy safety practices, friction between contractors, and drilling at the edge of technological limits, BP’s Horizon oil rig suffered a blowout that destroyed the rig and led to a months-long oil spill. The accident, detailed in depth here, led to the release of more than 4 million barrels of oil into the Gulf of Mexico.

Unfortunately, Congress did not set the same high standards for offshore oil drilling liability as they did for the nuclear industry: existing law capped damages at only $75 million. In face of a public relations nightmare that threatened BP’s social license to operate in the United States and globally, BP volunteered to cover all costs exceeding that cap.

Through 2018, BP paid more than $60 billion in civil and criminal fines, environmental damages, and other compensation to the public. Had it been any other company, tens of billions of public damage would have gone uncompensated. Further, the incident was caused by actions of multiple companies – BP’s decision to take responsibility both demonstrates the value of economic channeling in nuclear liability and underscores the risk had this gotten mired up in courts focused on individual company faults.

Without a proper liability framework, risky decisions like those underlying the BP Horizon disaster are not disincentivized. Source

Finally, we get to climate liability.

When it comes to climate change, it is relatively easy to establish fault. We have sufficient data to identify past and ongoing emissions by country and, in some cases, by company. There is an open question of when countries should have reasonably expected their emissions harm global environments, but it has been at least 30 years.

Rather, the primary challenge is establishing damages linked to specific emissions. Until then, uncovered climate change liability may the largest liability in the history of humanity. Assuming carbon costs of only $20/ton (a very low value), global emissions of ~1.5 trillion tons create an unfunded liability of over $30 trillion with ~$7.5 trillion for the U.S. alone.

Nuclear Liability is Relatively Comprehensive

Compared to other energy related mega-disasters, nuclear liability and insurance seems comprehensive and well thought out. The current scheme:

protects the public,

enables a commercial industry that can provide a critical energy service,

and has not yet cost taxpayers anything.

Price-Anderson and the broader regulatory framework has been effective at a primary goal: enabling the creation of private sector insurance products for nuclear liability.

The greatest lesson from an inquiry into nuclear liability and insurance is not that it is an externality nor that is a subsidy. Instead, it is that nuclear liability and insurance are models that we should adopt to other sectors like oil and gas, electricity, and climate.

For more information:

NRC Insurance and Liability Requirements for Small Reactors by NEI

The NRC has submitted a required report to Congress that, at 200+ pages, has more information about Price-Anderson than you will probably ever need: https://www.nrc.gov/docs/ML2133/ML21335A064.pdf

A spark notes version is available here courtesy of Morgan Lewis: https://www.morganlewis.com/blogs/upandatom/2021/12/nrc-concludes-no-major-congressional-changes-necessary-to-price-anderson-act